What You Get with Rupya

Empower your team with workflows that adapt to your needs, whether you prefer git synchronization or a AI Agents interface.

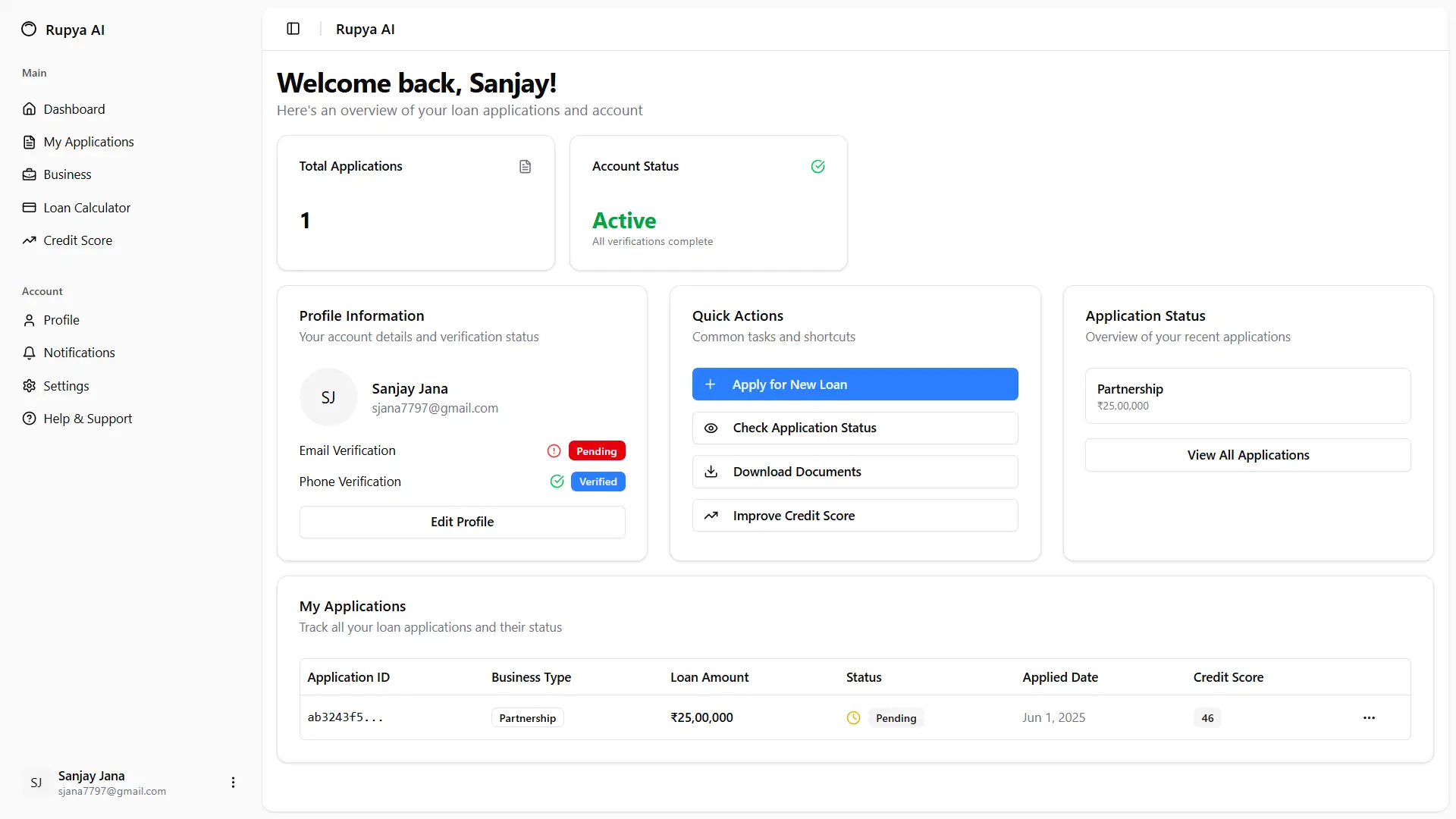

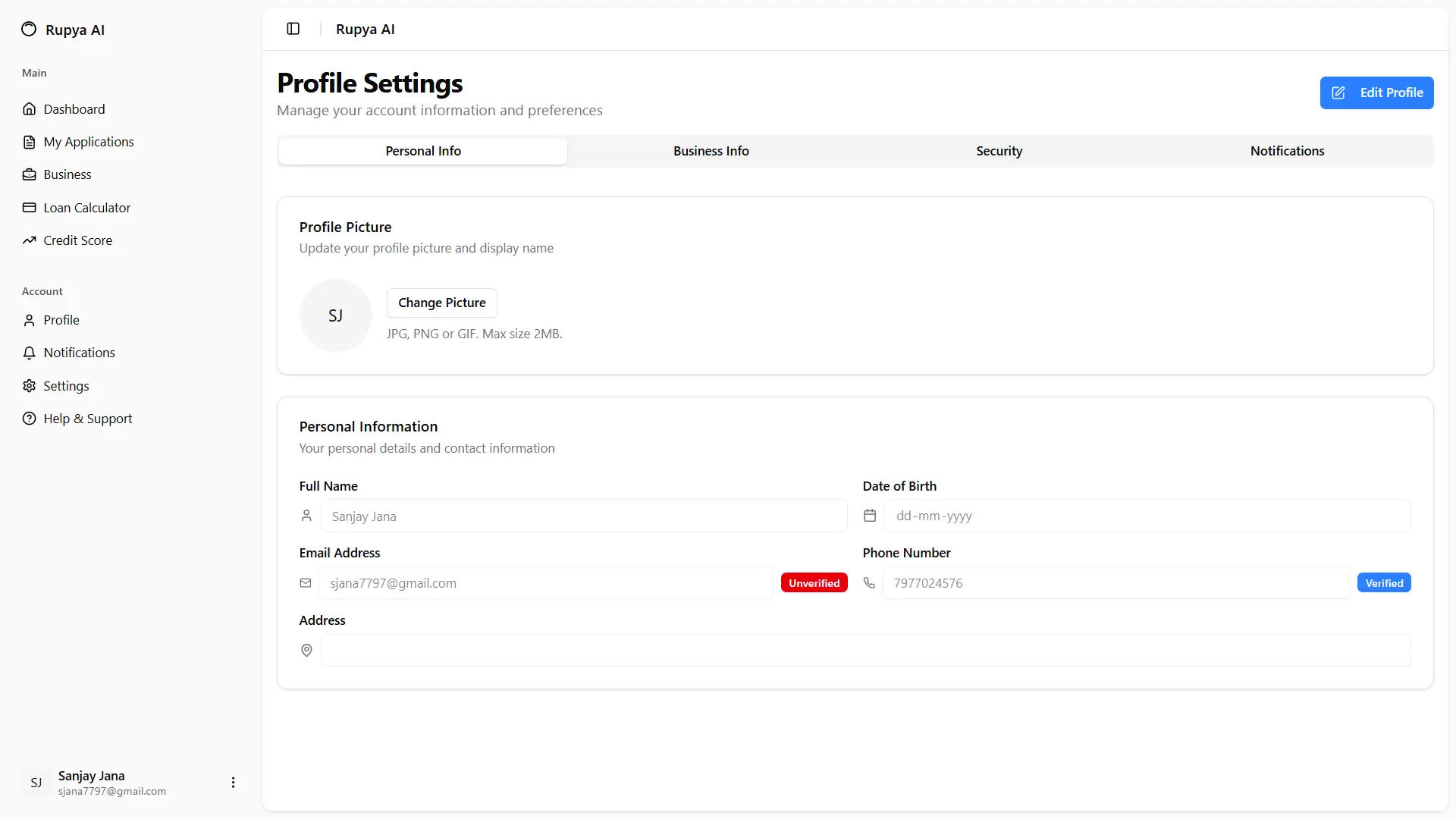

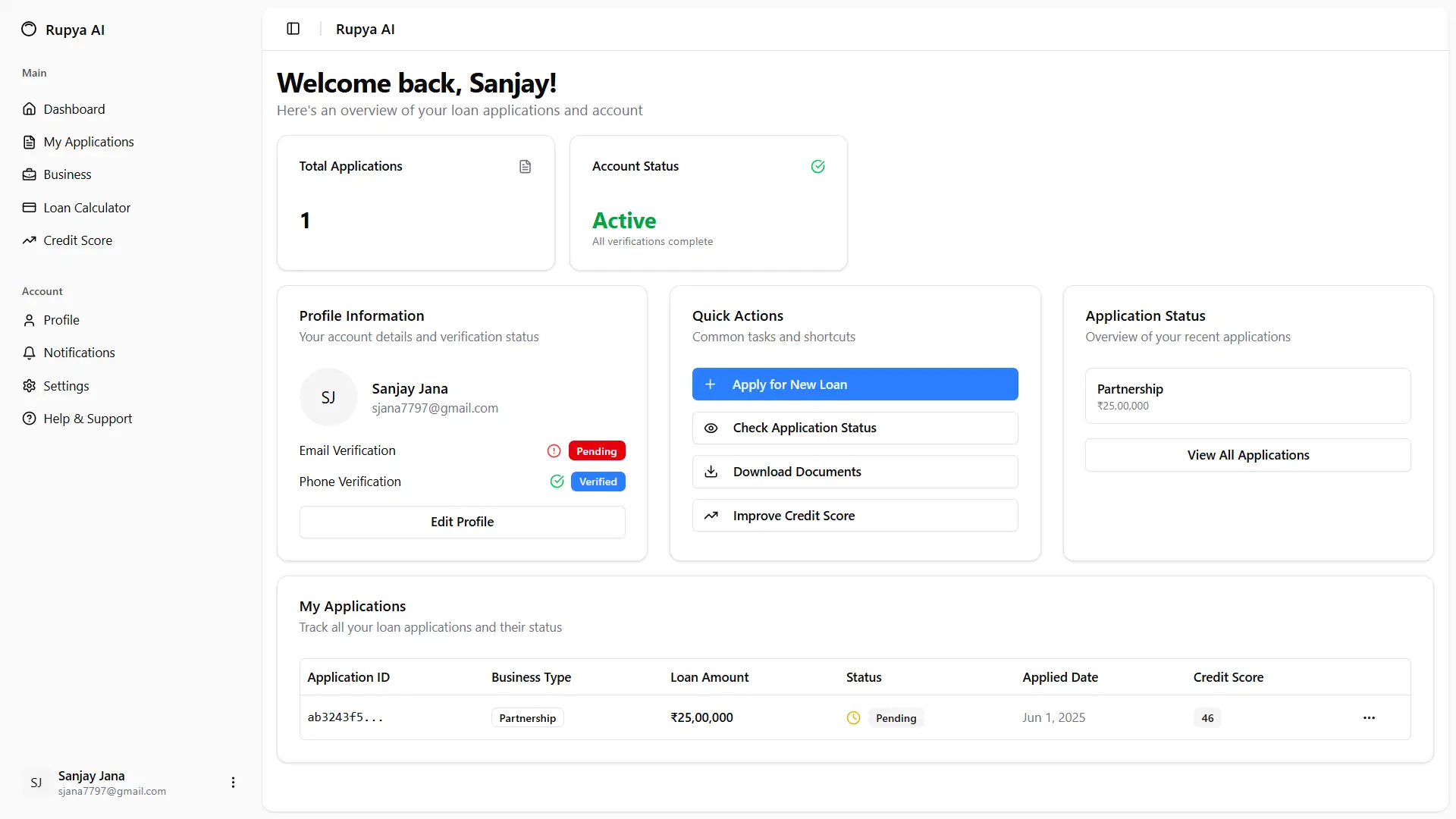

User Dashboard

Borrowers track EMIs, disbursals, repayment status, and upload docs—all in one place.

NBFC Dashboard

Track loan KPIs, verify KYC, manage customer pipelines, and monitor risk at scale.

Lending APIs

Offer lending-as-a-service via plug-and-play APIs—perfect for apps, marketplaces, and fintechs.

AI Powered

Deep dive into loan performance, default risk, and revenue growth.

For Individuals (Borrowers)

- Apply for a loan in minutes

- Track approval and EMI cycle

- Get real-time alerts

Dashboard

Track loan KPIs, verify KYC, manage customer pipelines, and monitor risk at scale.

Insight Analytics

Deep dive into loan performance, default risk, and revenue growth.

For NBFCs & Partners

- Deploy scalable loan programs

- Reduce ops cost with automation

- Integrate with CRMs or banking infra

Dashboard

Track loan KPIs, verify KYC, manage customer pipelines, and monitor risk at scale.

Insight Analytics

Deep dive into loan performance, default risk, and revenue growth.

Feel the Power

Rupya AI is a powerful AI-powered loan application platform that simplifies the loan application process, empowering users to access real-time loan applications and automate the loan approval process.